Some Known Factual Statements About Feie Calculator

Table of ContentsThe smart Trick of Feie Calculator That Nobody is Talking AboutHow Feie Calculator can Save You Time, Stress, and Money.The Single Strategy To Use For Feie CalculatorLittle Known Facts About Feie Calculator.Getting My Feie Calculator To Work

He sold his U.S. home to develop his intent to live abroad permanently and applied for a Mexican residency visa with his other half to aid satisfy the Bona Fide Residency Examination. Neil aims out that acquiring home abroad can be testing without very first experiencing the area."It's something that people require to be actually attentive regarding," he says, and encourages deportees to be cautious of typical blunders, such as overstaying in the United state

Neil is careful to stress to Tension tax united state tax obligation "I'm not conducting any carrying out in Service. The United state is one of the couple of nations that tax obligations its residents no matter of where they live, indicating that even if a deportee has no earnings from U.S.

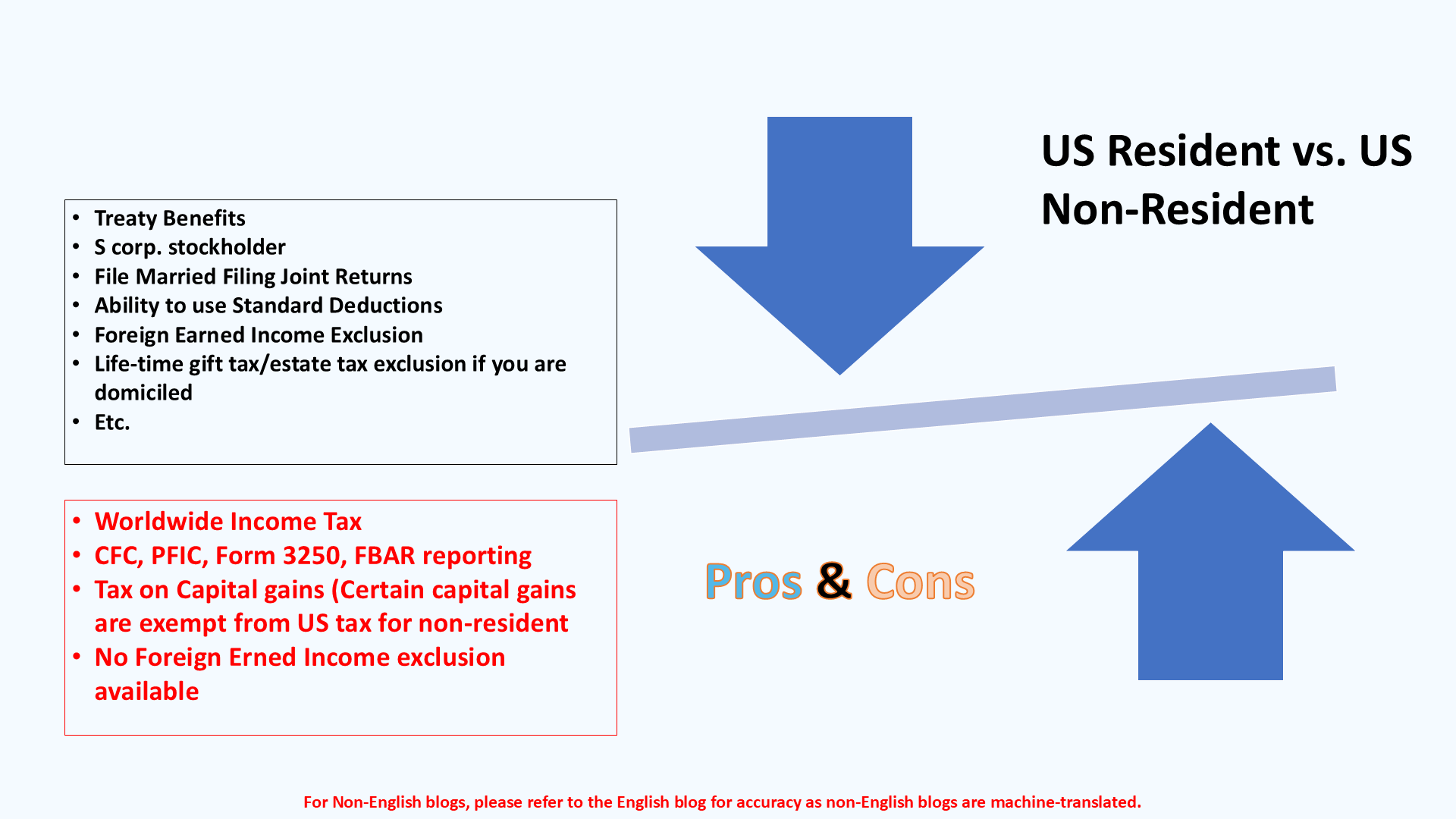

tax returnTax obligation "The Foreign Tax obligation Credit rating enables individuals working in high-tax nations like the UK to counter their U.S. tax responsibility by the amount they've already paid in tax obligations abroad," claims Lewis.

Little Known Questions About Feie Calculator.

Below are several of the most frequently asked concerns regarding the FEIE and other exemptions The Foreign Earned Earnings Exemption (FEIE) allows united state taxpayers to leave out up to $130,000 of foreign-earned revenue from federal income tax, minimizing their U.S. tax obligation responsibility. To receive FEIE, you must meet either the Physical Existence Test (330 days abroad) or the Bona Fide Home Examination (confirm your primary residence in a foreign nation for a whole tax obligation year).

The Physical Presence Test needs you to be outside the U.S. for 330 days within a 12-month period. The Physical Existence Examination also calls for united state taxpayers to have both an international income and a foreign tax home. A tax obligation home is defined as your prime location for service or work, despite your family members's house.

A Biased View of Feie Calculator

An income tax treaty between the U.S. and one more nation can aid protect against double taxation. While the Foreign Earned Earnings Exemption decreases gross income, a treaty might give extra advantages for eligible taxpayers abroad. FBAR (Foreign Savings Account Report) is a needed filing for U.S. people with over $10,000 in international economic accounts.

Qualification for FEIE depends on meeting details residency or physical existence tests. He has over thirty years of experience and currently specializes in CFO solutions, equity compensation, copyright taxation, marijuana taxation and separation relevant tax/financial planning issues. He is an expat based in Mexico.

The foreign gained earnings exemptions, often referred to as the Sec. 911 exemptions, omit tax on salaries gained from functioning abroad.

The Feie Calculator Statements

The income exemption is now indexed for inflation. The maximum yearly earnings exclusion is $130,000 for 2025. The tax advantage omits the income from tax obligation at bottom tax rates. Previously, the exclusions "came off the top" lowering earnings based on tax at the leading tax obligation prices. The exclusions might or might not lower income made use of for various other purposes, such as IRA limits, kid debts, individual exceptions, etc.

These exclusions do not spare the salaries from US taxation however merely provide a tax obligation decrease. Keep in mind that a single person working abroad for all of 2025 that earned concerning $145,000 with no other income will certainly have taxable income minimized to absolutely no - effectively the exact same response as being "free of tax." The exemptions are calculated each day.